Finance lease

Preservation of liquidity

Lease payment flexibility

No increase in the proportion of external liabilities on your balance sheet

Why opt for a finance lease

- SGEF purchases the asset, leaving your own resources and credit lines intact.

- You only begin making repayments after taking possession of the asset, i.e. from the returns generated by your use of the leased item.

- The lease payments are only entered in your profit and loss account. The asset and future lease-related liabilities do not appear on your balance sheet.

- Stronger cash flow – by spreading the VAT amount among instalments and claiming the VAT deduction at the start of the contract, you can free up additional resources.

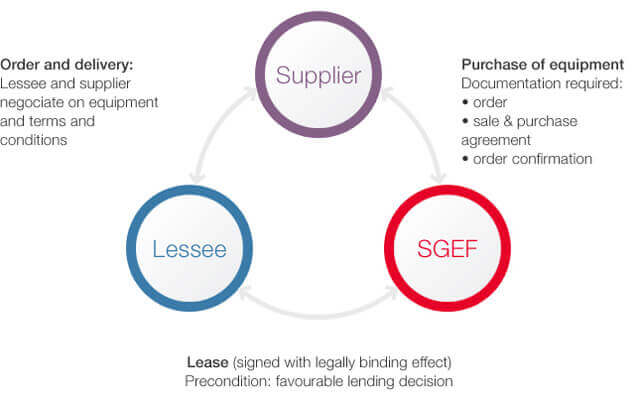

A finance lease is a form of long-term rental. You lease equipment from us, such as manufacturing machinery, transport equipment, or hardware, typically for several years, with the option to purchase the asset at the end of the lease term. During the lease, you make pre-agreed monthly or quarterly payments, covering the cost of acquisition and interest. These payments may also include insurance and, where appropriate, VAT.

At the end of the lease, you have the option to buy the asset at a previously agreed residual value. A finance lease allows you to access new technology or vehicles without the need for any substantial upfront outlay, and you can continue using the asset long after it has been fully paid off and acquired.

This type of lease is popular among businesses looking to expand their assets who prefer financing through regular payments, helping them to better manage their cash flow.

According to the VAT Act, the key factor in establishing that VAT is to be paid by the leasing company and that the lessee has the right to claim a VAT deduction lies in the economic substance of a transaction.

If the residual value of the financed asset is low or symbolic, it can be assumed the client will want to purchase the asset, making the transaction a supply of goods. If the contract qualifies as a supply of goods, the leasing company pays VAT on the full amount of the lease payments at the beginning of the contract.

If you are liable to account for VAT, you are entitled to deduct VAT at the start of the contract, based on the total of all lease payments and associated costs.

- If you want to optimise your free resources, you can spread the VAT amount evenly across instalments.

- If you prefer the lowest possible instalments, the VAT amount can be paid as part of a balloon payment after the VAT refund or added to the down payment.

- If the lease contract is terminated early, the VAT on the unrealised instalments will have to be “refunded” in the tax return, regardless of the method of payment.